Property insurance policy is something Many people have a tendency to delay, considering it’s just A different expense we don’t will need to worry about. But when lifetime usually takes an unpredicted transform, irrespective of whether as a result of fireplace, theft, or pure disasters, it’s your home insurance coverage that can save you from money spoil. So, what exactly is home coverage, and why do you want it? Enable’s dive into the world of household insurance policies, breaking it down in basic phrases so you realize why it’s A necessary Section of proudly owning a home.

Home insurance is really a style of policy that provides monetary defense for your home, its contents, as well as your liability if another person is injured on the residence. Consider your home as a large expenditure—household insurance policies is sort of a security Web, keeping that financial commitment secured against numerous dangers. With out it, if one thing ended up to occur to your home, you’d be still left to purchase repairs or substitution away from pocket, which may be very high priced.

Home insurance is really a style of policy that provides monetary defense for your home, its contents, as well as your liability if another person is injured on the residence. Consider your home as a large expenditure—household insurance policies is sort of a security Web, keeping that financial commitment secured against numerous dangers. With out it, if one thing ended up to occur to your home, you’d be still left to purchase repairs or substitution away from pocket, which may be very high priced.There are differing kinds of household insurance insurance policies offered, and deciding on the proper one can appear to be a bit frustrating at the outset. But don’t stress! The 2 most common forms are HO-1 and HO-three insurance policies. The HO-1 policy is among the most primary, masking a restricted number of perils like fire, theft, and vandalism. Conversely, HO-three guidelines tend to be more comprehensive, masking a broader range of challenges, which include accidental hurt and certain all-natural disasters.

Why is house coverage important? Visualize your home as your sanctuary. It’s where you sleep, consume, and generate Recollections together with your family members. An important occasion like a fire or flood could devastate your own home and anything within it. With out insurance, you could possibly confront huge costs and possibly lose almost everything. Property insurance coverage will give you assurance realizing that In the event the worst occurs, you received’t really have to bear the economical load alone.

Digital Insurance Solutions for Dummies

When you’re purchasing for household coverage, it’s crucial to be familiar with the coverage choices available to you. The basic principles generally consist of dwelling coverage, which protects the construction of your own home, and private property coverage, which handles your possessions. There’s also legal responsibility protection, which safeguards you if another person receives damage in your residence, and additional residing expenditures, which could help with prices if your house becomes uninhabitable due to a covered party.

When you’re purchasing for household coverage, it’s crucial to be familiar with the coverage choices available to you. The basic principles generally consist of dwelling coverage, which protects the construction of your own home, and private property coverage, which handles your possessions. There’s also legal responsibility protection, which safeguards you if another person receives damage in your residence, and additional residing expenditures, which could help with prices if your house becomes uninhabitable due to a covered party.Numerous homeowners believe that their residence insurance covers all kinds of harm, but that’s not often the situation. As an example, most regular policies received’t address flooding or earthquakes. If you live in an area at risk of these types of risks, you may need to acquire individual protection. It’s imperative that you diligently study the conditions of one's plan so that you’re completely mindful of what’s bundled and what’s excluded.

Yet another crucial variable to take into consideration is the level of coverage you would like. You don’t want to be underinsured and determine way too late that you don’t have adequate coverage to rebuild your house. Around the flip aspect, you don’t want to overpay For additional protection than you really have to have. To determine the proper level of coverage, you’ll must evaluate the value of your house and its contents, trying to keep in your mind things such as the expense of repairs and The present industry price.

With regards to selecting a residence insurance service provider, it’s crucial that you do your study. Glance for a company with a robust reputation for customer service and promises handling. In any case, when you need to file a declare, you'd like a business that’s intending to make the procedure as smooth as is possible. On-line opinions and term of mouth might be practical in making an educated choice.

Household insurance isn’t almost protecting your home; it’s also about guarding your own possessions. Take into consideration all of the items in your house—household furniture, electronics, clothing, and worthwhile objects like jewellery or artwork. If this stuff were Learn more being missing in a fireplace or stolen, would you be capable to afford to pay for to replace them? Private assets coverage ensures that your belongings are guarded too.

Besides shielding your belongings, residence insurance policy also addresses liability. If a guest is hurt even though viewing your house, you could be held chargeable for their clinical bills. Legal responsibility protection might help deal with these charges, which includes authorized costs in case you’re sued. This is very important if you have lots of holiday makers or host gatherings at your home on a regular basis.

The cost of property insurance coverage may differ dependant on several components, including the spot of your house, its measurement, the products Employed in its design, and the level of protection you select. Although house insurance policy might be high priced, it’s essential to think of it being an financial investment inside your upcoming. If anything were to happen to your own home, having insurance policies could conserve you A huge number of bucks in repairs and replacements.

Another thing quite a few homeowners forget to factor into their property insurance is the value in their residence’s contents. With time, you accumulate possessions—clothing, home furnishings, electronics, along with other precious things—That will not be included below The essential coverage. Make sure to preserve an inventory of one's possessions, together with their benefit, so that you can alter your coverage accordingly. It’s also a smart idea to get images or films of your belongings for documentation in case of a declare.

Insurance Solutions For Real Estate Things To Know Before You Buy

The smart Trick of Insurance Technology Solutions That Nobody is Talking About

If you acquire dwelling coverage, you’ll have to have to make your mind up in your deductible. The deductible is the amount you’ll fork out out of pocket before your insurance coverage kicks in. An increased deductible can reduced your monthly high quality, but In addition it indicates you’ll pay back more if you need to file a claim. Contemplate your finances and decide on a deductible that is sensible for the predicament.When you’re seeking to economize on residence insurance policies, there are several ways to do so. To start with, think about bundling your private home insurance with other policies, like automobile insurance policy. Lots of insurance plan corporations offer you discount rates for bundling, which can result in considerable price savings. Yet another way to save lots of is by putting in protection devices like alarms and cameras, which might lessen your hazard of theft and, subsequently, your high quality.

Do you want residence coverage if you’re renting? The solution is Of course, but in a different variety. Renters coverage delivers protection for your personal possessions and liability, however it doesn’t include the composition of the setting up by itself. In the event you’re leasing, your landlord’s insurance will address the home’s construction, but you’ll need to have renters insurance policy to protect your belongings in the event of theft, fireplace, or other protected situations.

5 Simple Techniques For Customizable Insurance Solutions

When you’re a first-time homebuyer, navigating the earth of household insurance can truly feel frustrating. But don’t be concerned! Several insurance plan corporations supply assets and guides to assist you fully grasp your options. Just take your time and effort to assessment the several guidelines, Evaluate prices, and speak with an agent to find the very best protection for your preferences.

3 Simple Techniques For Global Insurance Solutions

Once you’ve picked a house insurance policy, it’s vital to review it often. Your protection Get more details requires might change after some time, particularly if you make renovations to your private home or obtain beneficial items. Frequently examining your policy makes certain that See the full article you’re constantly adequately lined, and it can assist you steer clear of sudden gaps in protection.

It’s essential to Take note that home insurance plan isn’t just for homeowners; it’s also for landlords. In case you hire out your home, landlord insurance policies is crucial to protect your investment decision. This type of insurance commonly covers the constructing itself, lack of rental earnings, and legal responsibility in the event a tenant is hurt about the residence.

In conclusion, residence insurance is not merely an optional cost—it’s a requirement. It safeguards your property, your possessions, and also your monetary upcoming. No matter if you’re a first-time homebuyer, a seasoned homeowner, or possibly a renter, getting the right insurance coverage protection may make all the main difference. So, make an effort to buy all-around, Look at policies, and find the protection that’s ideal for you. After all, your home is among your most respected property, and protecting it is the wise preference.

Josh Saviano Then & Now!

Josh Saviano Then & Now! Destiny’s Child Then & Now!

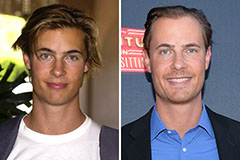

Destiny’s Child Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!